20 March 2025, Oslo, Norway: Leading global sports and entertainment agency Fuse, part of Omnicom Media Group, has announced Marius Ramdahl as Head of Fuse Nordics. The creation of the new regional role follows the recent expansion of Fuse into Sweden and Finland. Through Fuse, OMG will leverage the growing potential of sports and entertainment marketing in the Nordics, offering consultancy services to support brand advertisers with their partnership needs.

Ramdahl has been selected to lead the regional Fuse business unit from Oslo; the appointment will be an additional remit to his successful six-year tenure as Managing Director of Fuse Norway. The Norwegian office has already gained significant recognition by winning gold at the global Festival of Media and Sabre Awards, as well as gold in the Gullblyanten, Medieprisen, and Sponsor & Eventprisen competitions.

CEO of Omnicom Media Group Norway, Espen Klepper, is particularly pleased that his Norwegian colleague has been chosen to lead Fuse in the Nordic region. “I have nothing but praise for Marius, and there is no doubt that what we have achieved in Norway so far has been a fantastic success. We clearly see that our clients are increasingly looking for ways to engage more deeply with their audiences, and sports and entertainment are platforms that truly deliver on this. The launch of Fuse in the Nordics will undoubtedly strengthen our commitment to bringing brands closer to people through the things they love,” says Klepper.

Ramdahl himself is excited about the new challenges: “It has been an absolute pleasure to lead Fuse in Norway from the very beginning, and I look forward to the challenge of a broader presence in the Nordic market. Many of our clients operate across borders, so we look forward to offering them a wider range of services in the region while also helping to elevate local brands in each country through the power of sports and entertainment.”

The sponsorship market in the Nordics amounts to over 20 billion NOK, with the majority of investments directed toward the sports category. “With our holistic approach to commercial partnerships, combined with our extensive international experience, we are aiming to take a leading position in the Nordic market. We are proud of what we have achieved in Norway so far and are highly motivated to build on this success in our new markets,” Ramdahl concludes.

Commenting on the Nordic launch, Louise Johnson, Global CEO of Fuse, stated: “Our extended coverage in the Nordic region is a crucial strategic move for Fuse – not only to enable us to leverage the significant opportunity we see in this region, but also to deliver more to the existing Fuse client base – many of which require regional support. As part of OMG, Fuse is uniquely positioned to unlock the potential in this region: combining the group’s leading data and technology capabilities – – powered by the industry-leading Omni open operating system – with our expertise in connecting brands to culture through effective partnerships truly sets us apart.»

Fuse recently launched in Sweden and Finland, led by Chris Drake and Sanna Tamminen, respectively.

During this decade, we have seen globally acclaimed sports like football, motorsport and basketball commit to championing the women’s game. Therefore, we are seeing more women step up to be the face of the women’s game, such as Leah Williamson, Bianca Bustamante, Caitlin Clark and Angel Reese to name a few.

However, within the last year we have seen one woman’s career and profile transcend their sport at an unprecedented rate. Ilona Maher has become nearly impossible to miss, managing to build her brand and effortlessly adapt to the changeable appetite of society, popular culture and social media. She has shown that female athletes’ potential can be bigger than just the dimension of their sporting career. But what has this looked like and what can it teach the industry about incubating the future talent that are surely hot on her heels?

It is Ilona’s world, and we are all just living in it

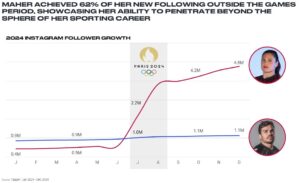

With her bubbly, straight-talking personality, Maher gained over 6M additional followers across Instagram and TikTok since the Paris 2024 Olympics, dwarfing the growth of male rugby royalty such as Antoine Dupoint. Online buzz around the athlete increased by 4,824% from 2023 to 2024.

This “Beast, Beauty, Brains” athlete has become a force of her own, galvanising support for whatever direction she takes her career. For example, her shift from rugby sevens to rugby union has raised the profile of the English game and its teams. This was evident in her signing announcement with Bristol Bears, which helped the club gain over 22K followers on TikTok in the week following the reveal.

Source: Bristol Bears TikTok account (@bristolbearsrugby)

The announcement post alone generated 366.7K visible engagements, making it their most successful piece of content since starting their page in 2024 – an increase of +2,918%, compared to their channel average (12.2K visible engagements)[1].

A sticking point for female athletes in building fandom beyond their individual sport to wider sports fans is often a lack of authentic male allyship and support that feels genuine rather than obligatory (as seen in traditional partnerships between men’s and women’s national teams). The strong endorsement for Ilona from male rugby legends like Dan Cole and Ben Youngs likely played a role in firstly, helping newfound women’s rugby fans feel included and accepted as part of the rugby world, and secondly, instigating conversation and curiosity for the women’s game amongst the men’s rugby community.

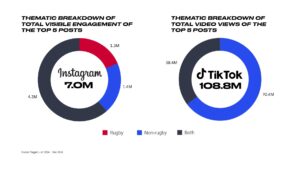

Ilona’s influence has also extended beyond the pitch. She often stole the show on Dancing With The Stars, with social media snippets of her iconic dances being some of the most popular content on their Instagram (4 of the top 5 posts feature Ilona), amassing just under 2M visible engagement [2]. She also was recognised and celebrated for her empowered femininity as a cover star on Sports Swimsuit Illustrated, People and Cherry Bombe.

In short, 2024 saw the full force of the Ilona Maher effect, with her influence making her bigger than rugby, and providing a blueprint for future female talent in the sport and entertainment space.

The Ilona cheat code

Ilona straight-armed her way through the glass ceiling, and her success is far from accidental. Whilst societal and contextual influences have played a role in creating an environment where she could flourish, Ilona and her team have been highly intentional with her brand and image.

Firstly, with over 5 billion users on social media channels globally [3], Ilona has leveraged the world’s insatiable consumption of content to expand her reach and connect with as wide an audience possible. On the podcast The Good, The Scaz & The Rugby, she highlighted the difference in her attitude towards social media versus her teammates, admitting that she embraces scrolling as part of her work, always researching social media trends to widen her audience appeal. Maher’s channels are reflective of popular culture but also infuse her signature Ilona twist with the occasional “sprinkle of rugby”, enticing curiosity amongst her new audiences, potentially converting them into engaged fans.

Secondly, the current political and societal climate is tumultuous, and in extreme cases hostile towards any kind of otherness. Ilona is passionate about empowering people and instilling self-belief through comedic sincerity. Naturally, being in the public eye invites intense public scrutiny but Ilona’s ‘take-me-or-leave-me’ attitude cleverly acknowledges but denies power to the unsolicited opinions from trolls or anti-fans. Maher is also an unapologetic ally for the talent of others, as we’ve seen post-Olympics, when she used her newfound influence and notoriety to encourage her audience (4.8M of which she gained during the Olympic period [4]) to keep audiences engaged with the Paralympics. Ilona is a fierce advocate for self and otherness acceptance, which is something the world needs now more than ever.

Finally, Ilona challenges the rigid standards put on female athletes – and women generally – reminding us there is no right or wrong way to exist. She has not pigeonholed herself as just an Olympian (although it is an impressive pigeonhole) or just an online personality. Her ‘say yes’ approach to non-rugby opportunities has helped her to cultivate her fandom beyond the women’s rugby sphere, giving her an ongoing relevancy within pop culture. This is most clearly reflected on her social media, specifically on her Instagram and TikTok where all or the majority of her top 5 posts are unrelated to rugby or not solely rugby focused (breakdown can be found in the Appendix).

How can brands (and rightsholders) harness such power

While 2024 was Ilona’s year, she has been grafting hard on social media, cultivating her brand since her first Olympic appearance at Tokyo.

Keeping abreast of the current talent landscape – looking at top performers, emerging personalities, and intersectionality innovators between their industry and culture – is key. Spotting these stars early will help brands to align and build in conjunction with their success. Whilst there is only one Ilona Maher, there are others like her across sports and entertainment waiting to be discovered.

Authenticity matters – fans can see through surface-level partnerships that simply feature the most followed/biggest stars. If brands want to use talent effectively, they need to identify and clearly define what their assessment criteria is before researching potential ambassadors/collaborators. Knowing what data-led and subjective brand fit KPIs are important for improving your brand’s image is key to aligning with the best talent. These pre-determined selection criteria can also be used as part of a measurement framework to monitor the effectiveness of the talent and identify actionable insights to improve campaign strategy. By taking a strategic approach, brands can identify talent avenues that naturally complement their identity, ensuring partnerships feel genuine and create mutual value.

Once you have identified and signed talent, they should have a seat at the creative table. By actively including talent in creative brainstorms, brands can ensure that the signature flare and persona that makes them beloved is organically weaved into the campaign’s fabric. A recent example of this for Ilona was the Adidas partnership, which still had the brand’s style but through Ilona’s lens. Ilona has helped to further this by providing supplementary behind-the-scenes content on her own channels, emphasising that she is more than just a face in the brand’s ambassador roster, but a proactive part of the Adidas family.

Rightsholders should start considering the social influence and inventory that their female talent and performers are building. Understanding their passion points and social media literacy in general can help rightsholders:

Ilona’s success didn’t happen overnight, despite 2024 appearing that way. She put in the work, and for the rest of this decade, many more female athletes will follow suit. Brands that take notice sooner rather than later will give themselves a head start to create and harness their own Ilona Maher effect.

Sources

Appendix:

Breakdown of top 5 posts on Ilona Maher’s Instagram and TikTok channels:

| Visible Engagement | TikTok | Views | |

| Comparison between Ilona on the red carpet and before a rugby game | 1.9M | Dancing with the Stars – Leg Lift Challenge | 29.5M |

| Meeting Snoop Dogg | 1.4M | ‘When you and your friends are complete opposites’ | 22.5M |

| Olympic Medallist Portrait | 1.3M | Making Moves in the Olympic’s Villa | 20.7M |

| Making Moves in Olympic’s Villa | 1.2M | Paid Partnership with L’Oreal Paris | 18.4M |

| ‘Women can do it all’ | 1.2M | Dancing With the Stars Funny BTS | 17.7M |

Once considered a niche motorsport with a predominantly European following, Formula 1 has exploded into a global phenomenon in recent years, fuelled in large part by Netflix’s Drive to Survive. F1: The Movie builds on this momentum, delivering cinematic excitement but also a deeply authentic, culturally resonant portrayal of the world of modern Formula 1. The film leverages this unique cultural moment for the sport, using the global fascination inspired by Drive to Survive as a springboard and leaning into what fans love most: real access, real emotion and real racing.

But this is more than just a film – it’s a cultural inflection point. F1: The Movie blurs the lines between sport, entertainment, and storytelling, offering a new blueprint for how sports properties can engage fans beyond the track. It signals a shift from passive sponsorship to active participation in the stories fans care about.

From the first email, when director Joseph Kosinski reached out to seven-time world champion Lewis Hamilton, the vision was clear; to make something real and accurate. Hamilton, who served as a producer, was instrumental in ensuring the film mirrored the identity of the sport. To achieve this, a fictional “11th team” was created, APXGP, fully integrated into the 2023 and 2024 F1 seasons with its own motorhome, garages, team sponsors, and interacting seamlessly with real teams and drivers across specific race weekends. The two lead actors, Brad Pitt and Damson Idris, trained to drive modified F2 cars designed to look and feel like F1 vehicles. This realism, supported by a specially developed camera system tailored to the unique demands of high-speed racing, deliver a radical on-track perspective bringing audiences and fans closer than ever to the speed, precision and experience of Formula 1.

The authenticity of F1: The Movie is amplified further through the film’s commercial integration which mirrors the business engine that drives modern Formula 1. APXGP’s team livery features real sponsors including MSC Cruises, Expensify, SharkNinja, and Tommy Hilfiger – brands that clearly recognise the sport’s growing global influence. These partnerships go beyond simple product placement; they’re part of a larger ecosystem positioning F1 as an ideal platform for premium, lifestyle-driven marketing.

Tommy Hilfiger stands out as a brand that has maximised the sponsorship with a bold activation strategy not only designing the APXGP team suits, but launching a capsule collection inspired by the film. The brand integration reached a new level at the 2025 Met Gala where Damson Idris arrived in a real APXGP car wearing a bespoke Tommy Hilfiger racing suit and a Swarovski-crystal-encrusted helmet. On the red carpet, two assistants performed a “pit stop,” removing Idris’ racing suit to reveal a tailored Tommy Hilfiger suit underneath, aligned to the evening’s theme. The Met Gala appearance was more than just a viral spectacle, it was part of a fully integrated marketing campaign. The APXGP Collection, modelled by Idris, is now being marketed worldwide, with a global out of home and digital campaign rolling out across multiple channels, amplifying brand visibility and connecting F1 to a broader lifestyle audience. The impact of the campaign has been noted by other sponsors, such as Expensify, who also saw a surge in brand engagement following the Met Gala reveal.

These kinds of activations serve as a gateway to new audiences. The Met Gala moment wasn’t just for motorsport fans; it was for culture-watchers, fashion enthusiasts, and digital natives who may have never tuned into a Grand Prix but instantly connected with the spectacle. By tapping into culturally charged moments, F1 and its partners are expanding the sport’s cultural footprint, through moments that feel relevant, shareable, and emotionally resonant across different verticals. As Apple CEO Tim Cook described the film, it’s “the intersection of technology and sport” – and the Met Gala moment exemplified exactly that, where entertainment, fashion, and motorsport collided on a global stage.

Some may also question the risk it poses for brands if the film doesn’t perform well or underdelivers – however, the smartest activations aren’t just betting on box office numbers. They are building campaigns that stand on their own where it isn’t a one-off product placement and are creatively valuable in their own right.

With Hamilton’s guidance, racing integration, revolutionary technology, and real-world commercial partnerships, this film sets a new standard for motorsport storytelling and marketing. F1: The Movie is more than a Hollywood drama. It’s a culturally resonant, deeply authentic celebration of Formula 1 and a global marketing platform expanding the fanbase whilst showcasing the sport’s unmatched opportunity and commercial potential. Additionally, it offers a glimpse into the future of brand storytelling – one where entertainment doesn’t just support sport, but builds the platform itself. The fictional APXGP team wasn’t an add-on: it was engineered from the ground up with brand integration at its core. That gives brands a seat at the creative table from day one, enabling deeper engagement with fans. As the lines between sport, culture, and entertainment continue to blur, F1: The Movie isn’t just a cinematic milestone – it’s a playbook for how brands can show up authentically and drive relevance.

Fuse partners with Sipsmith to launch new Wimbledon-exclusive gin, Top Seed

26th June, 2025, London – Sipsmith has appointed global sport and entertainment marketing agency Fuse as its agency for partnership consultancy and activation, as it launches Top Seed Gin to celebrate the fifth year of its partnership with Wimbledon.

The born-and-bred London gin brand has crafted a new, limited-edition signature serve exclusively for The Championships. This first-of-its-kind recipe features authentic Wimbledon Centre Court grass seeds as one of its botanicals, distilled into the liquid using the same meticulous process behind Sipsmith’s iconic London Dry Gin. A team of expert distillers handcrafted the recipe at the brand’s Chiswick distillery, where every bottle of Sipsmith gin is made.

Fuse led the creative concept for Top Seed, from ideation to exclusive launch at an event hosted by Wimbledon legend and Sipsmith ambassador, Sue Barker, where guests were treated to a behind the scenes look into how the unique gin was created.

Tennis fans will be able to order Top Seed Gin by requesting a ‘secret serve’ at the Pergola Bar. The off-menu cocktail, The Top Seed, pairs the gin with Cloudy Apple Juice, Elderflower Cordial, Supasawa and a splash of soda. Each serve will also come with a bag of Wimbledon seeds so fans can grow their own botanicals at home, making a memorable experience for tennis fans and gin lovers alike.

Fans not able to make it to SW19 will still be able get their hands on The Top Seed’s authentic grass-based mix by signing up to Sipsmith’s Sipping Society.

In the lead up to Wimbledon, Fuse is also providing end-to-end delivery support, from strategic consultancy to onsite activations at the Pergola Bar and hospitality suite. Fuse will also manage ticketing and hospitality to ensure a seamless experience for Wimbledon-goers throughout the tournament.

Danielle Barwick, Group Director at Fuse, said: “We’re thrilled to be partnering with Sipsmith to work on this iconic Wimbledon partnership. From creative ideation to on-site execution, our team is dedicated to delivering a bold, celebratory campaign that blends Sipsmith’s spirit and commitment to craftsmanship with the tradition and prestige of The Championships. We’re looking forward to one big splash this year!”

Amy Cockram, Global Senior Brand Manager at Sipsmith, said: “Fuse’s expertise and experience in creative activations, experiential events and PR makes it the perfect partner to help us celebrate our collaboration and capture the spirit of Sipsmith and the magic of The Championships. We’re excited for more truly unforgettable moments at the most prestigious global sporting event on the calendar this year. ”

ABOUT FUSE

Fuse is a global sport and entertainment agency offering marketing and commercial services for brands and rights holders. It has offices in the UK, Europe, the Americas and Asia with over 400 employees internationally, recently opening hubs in Spain, Brazil and India. Its global CEO is Louise Johnson – one of Sports Leaders Under 40 and this year’s Jury President of the Entertainment Lions for Sport at Cannes Lions. Fuse’s work has been recognised across industry leading awards including Cannes, The Sports Industry Awards and the UK Sponsorship Awards. https://fuseint.com/

Omnicom Media Group is the media services division of Omnicom (NYSE: OMC), a leading provider of data-inspired, creative marketing and sales solutions.

From left to right: Charlotte Jacques, James Tollington, Luke Bliss

8th May 2025, London: Global sport and entertainment agency, Fuse, has announced a trio of promotions as it looks to strengthen and expand its Executive Leadership team. Luke Bliss has been promoted to Managing Partner, PR & Creative, James Tollington to Managing Partner, Client, and Charlotte Jacques to Managing Partner, Events & Live Experiences.

Previously Head of PR, Luke Bliss steps into the newly created role of Managing Partner, PR & Creative. Since joining the business in 2017, Luke has grown Fuse’s specialist PR division into an award-winning service that supports several Fuse clients across their sport and entertainment sponsorships, including Google’s partnerships with Arsenal F.C. and Liverpool F.C., Vodafone’s Rugby, Tennis and Music partnerships, and Panini’s football collections, amongst others. Luke will remain focused on the continued growth of the division, with an expanded remit to unify and lead the agency’s creative capabilities into 2026.

Group Director James Tollington has been promoted to Managing Partner, Client, with a remit focused on delivering industry leading consultancy across Fuse’s largest international clients, as well as driving client growth and new business. With over 15 years at the agency, James has led major accounts such as Vodafone, Google Pixel, Nissan and Santander, and has been instrumental in negotiating some of his clients’ most high-profile sports partnerships, including Vodafone’s deals with the Welsh Rugby Union, Scottish Rugby and Wimbledon. Internally, James will be responsible for strengthening Fuse’s consultancy offering and talent, and will help shape the agency’s broader strategic direction.

Charlotte Jacques has been promoted from Partner to Managing Partner, Events & Live Experiences, where she will oversee the strategic growth and execution of Fuse’s live event and experiential offerings. With 14 years of experience in the sports and major events industry, Charlotte has worked for local organising committees, specialist event and hospitality agencies and worked with numerous governing bodies such as UEFA, FIFA, IOC and the ICC. At Fuse, Charlotte has delivered standout brand experiences for clients such as HTC, Carlsberg, UniCredit, Nissan, PepsiCo, Enterprise, Santander, and Just Eat Takeaway.com. Her work spans some of the world’s largest sport and entertainment properties and events.

The new Managing Partners will report into Louise Johnson, Global CEO of Fuse. They will be instrumental in delivering Fuse’s global proposition – Culturally Connected, Seriously Effective – using their deep expertise to connect brands to culture and drive meaningful results.

Louise Johnson said: “These promotions reflect Fuse’s commitment to career progression and development, as well as our ongoing ambition to deliver best-in-class campaigns and partnerships for brands in sport and entertainment. Luke, James and Charlotte have already significantly contributed to the growth of the business over a number of years and will now bring a wealth of experience to their new roles.”

Luke Bliss said, “Fuse is an agency with wonderfully talented people and a roster of brilliant clients and we’re immensely proud to have played a part in its growth over the past decade. Our focus now is to make sure that success continues long into the future by retaining the very best of what we do now, while evolving our products and services to consistently meet our client’s needs. There’s never been a more exciting time to work in Sport and Entertainment at one of the world’s leading agencies.”

About Fuse

Fuse is a global sport and entertainment agency offering marketing and commercial services for brands and rights holders. It has offices in the UK, Europe, the Americas and Asia with over 400 employees internationally, recently opening hubs in Spain, India and Brazil. Its global CEO is Louise Johnson – one of Sports Leaders Under 40 and last year’s Jury President of the Entertainment Lions for Sport at Cannes Lions. Current international clients include PepsiCo, Vodafone, Nissan and Philips. Fuse’s work has been recognised across industry leading awards including Cannes, The Sports Industry Awards and the UK Sponsorship Awards. https://fuseint.com/

Gamechangers and Rainmakers is the story of how sport became big business, along with 40 pivotal moments that helped create a trillion-dollar global entertainment industry.

The growing relationship between sport, television and the advertising industry has been key to this development – as have the boundless ambitions of influencers such as Bernie Ecclestone, Billie Jean King, Rupert Murdoch and the founders of Adidas and ESPN.

The 1980s was the defining decade when sport morphed into primetime entertainment and Nike invented the playbook for brands. Ten years later, Sky won the inaugural Premier League TV contract, UEFA re-launched the European Cup, and a global fan base got hooked on the real-world drama of football, fantasy league, videogames and online betting.

As the value and profile of sport soared, investors wanted to own teams, while prosperous nations wanted to host the top events – which led to a firehose of unregulated cash and rogue behaviour by some of sport’s top bosses.

This fascinating book analyses how and why this happened, exploring the new challenges facing sport, such as how it must adapt to stay relevant to young people. Did sport peak at Paris ’24 or is the best still to come?

About David Stubley

David spent the first decade of his career working in television at ITV and Channel 4. The last 25 years have been spent advising some of the world’s top brands, governing bodies and sporting properties on how to unlock value through sports marketing.

He wrote this book for two reasons. First, to tell the untold story of how sport morphed from being an amateur pastime played on Saturday afternoon – to killer content for modern day brands and broadcasters. Second, to provide a rallying cry to sports leaders to create a roadmap for their sports which excites the next cohort of fans: A restless generation who see the world (and consume content) very differently to their parents.

As India’s sports ecosystem evolves, brands are beginning to look beyond cricket to explore emerging opportunities in sports like kabaddi, football, and athletics.

Why it matters

In a country where cricket has long monopolised sponsorship budgets, India’s broader sports marketing

landscape is reaching a pivotal moment. With changing audience behaviour, digital fandom, and the success of athletes on global platforms, brands have an opportunity to redefine how they engage with Indian sports moving from transactional sponsorships to long-term, narrative-driven partnerships that can shape both brand and sport legacies.

Takeaways

It’s 2025, and the Indian sports sponsorship landscape is still largely dominated by one sport: cricket. In fact, almost 90% of all sports revenue in the country is concentrated on it. But there is growing demand for

alternatives and the potential is undeniable. We’ve seen audience preferences shift in recent years, and alongside some new government initiatives, the call for non-cricket sports leagues has grown – and with it, new avenues for brands. While cricket spirit in India is unmatched, the next growth wave will come from brands thinking outside of traditional cricket-based models.

The new era of sports sponsorship

Expanding sports sponsorship out of cricket’s shadow is not just a diversification strategy, it’s an investment in India’s evolving sports culture. Not only have sports popular in the West made an impact in India, such as football, popular with young fans and urban audiences through the Indian Super League (ISL), but also Indian and South Asian sports, such as kabaddi. As brands compete for attention, creativity and proposition differences will be instrumental for differentiation. Those looking to capitalise on this new wave are frequently looking beyond the sports to the athletes.

Athletes as new brand vehicles

Success in international arenas such as the Olympics has turned athletes like Neeraj Chopra, Saina Nehwal

and PV Sindhu into household names, helping usher in individual sponsorship deals. For example, following his success at the Tokyo Olympics in 2020, javelin thrower Neeraj Chopra has become one of the most sponsoredindividuals in India and the face of several prominent campaigns, including Samsung’s #IndiaCheersNeeraj campaign, which highlighted his sporting resilience alongside its Galaxy Z Fold6 smartphone launch.

However, brands are going beyond pure-play monetary sponsorships. Puma recently celebrated the launch of its new ambassador, PV Sindhu, with an intriguing temporary rebranding exercise that got people talking. By replacing ‘PU’ with Sindhu’s initials ‘PV’, its fresh idea in creative brand integration gained impact. And with badminton’s popularity growing, it now boasts around 57 million fans in the country, Puma’s foray into the badminton sphere is well-timed. Given the grassroots reach that Badminton holds across India, it will be interesting to see how it sustains the noise around the brand through local-level activations and more. Cricket has demonstrated the power of brand extensions, as seen with Virat Kohli’s one8 company. What started off as the cricketer’s jersey number (18) today extends into One8 premium sportwear brand, a chain of restaurants under the name ‘One8 Commune’ and footwear brand One8 Select.

Rethinking sponsorship: Infrastructure, not just logos

There are, of course, several challenges brands face in this arena, not least infrastructure. Investment must

extend beyond sponsorship logos and focus on funding improvements to the whole sporting experience. Picture an FMCG giant reallocating some of its sports marketing budget to improving in-stadium facilities, such as better seating, faster food services, and interactive fan zones. The pay-off would be better experiences and better brand connections with that sport, making your brand synonymous with the sport’s long-term growth.

What non-cricket sports can offer

This is where sports outside of cricket have been making ground and offer significant brand opportunity. The inception of the Pro Kabaddi League (PKL) in 2014 rapidly increased the sport’s following, bringing in a wider audience across its 11 seasons. But it’s the League’s fan-first approach, investment in regional stadiums and a pivot to digital-first fandoms that have been crucial in making kabaddi the second-most watched sport in India. The PKL and ISL have gained mass traction via Disney+, Hotstar and FanCode, which have extended viewing options beyond traditional TV.

The growth of social media and OTT platforms has also enabled brands to build deeper, more personalised connections with sports and increased fan loyalty for homegrown, non-cricket icons. The PKL and ISL have seen double-digit growth in sponsorship revenue as brands pursue new non-cricket platforms and seek first mover advantage, with higher brand recall and increased authentic audience engagement.

The rise and role of leagues

Leagues have widened sports following in India by introducing professional, structured and entertaining formats that appeal to diverse audiences – and brands. Following the success of the Indian Premier League (IPL) in cricket, more than 25 leagues in different sports have emerged. The rise of leagues like ISL in football, kabaddi’s PKL, Ultimate Table Tennis (UTT), and the relaunched Hockey India League, calls for diversification in sponsorship strategies. Brands embracing these leagues are increasingly seeing value in long-term equity building through athletes, academies and infrastructure.

Indian conglomerate, JSW, has pioneered multi-sport investment, investing in cricket (Delhi Capitals) alongside strategic expansions into football, wrestling and Olympic sports. JSW’s partnership with Neeraj Chopra demonstrates long-term athlete investment and has firmly associated JSW with India’s golden boy of athletics.

The collaboration highlights how brands can shape – and grow with – an athlete’s legacy. The best strategies start from the ground up, where brands partner with academies and training programmes to

nurture young talent while building brand equity. This approach not only provides more interesting brand angles and storylines, but also a lower-cost entry point into sports sponsorship.

Fandom as the engine of sports marketing

Fandom has been critical in building the Indian sports industry. Passionate fans demand live events, experiential offerings, media content and merchandise – all crucial for boosting teams’ and leagues’ revenue. It is fan noise, both online and offline, that attracts the sponsorship, advertising and broadcasting deals necessary to make a sport financially sustainable.

India’s sports fandom is no longer just about watching matches – it’s about following athletes, engaging in communities, and being part of a movement. For brands, the strategy must shift from short-term sponsorships to long-term legacy building – the Jordan Way.

The real challenge lies in keeping fans engaged beyond the tournament. This starts by thinking of fans as more than just lovers of the sport, but as spokespeople who can convert others and will champion your messaging – be it as simple as ‘I’m a fan of the Haryana Steelers’, all year long.

Superfans are the basis of the support structure; engaging fans and connecting with team merchandise, wearing team colours, or promoting individual players is key to the sport’s growth and wider participation. In 2021, the news that Souled Store had officially partnered with Liverpool Football Club to sell merchandise was a major start and brought the club’s 96 million Indian fans closer to the UK-based team.

What brands must do next

The call is for brands to:

1. Partner, don’t just sponsor: Whether with leagues, federations or athletes – go beyond visibility and

enable real progress.

2. Invest in athletes as brands: Build long-term equity by helping athletes grow their personal brand, not

just endorsing them for a season.

3. Own the fan experience: Across infrastructure, digital and activations, brands must elevate how fans

interact with their favourite sports and stars.

4. Shape the emerging sports narrative: Cricket will always be king, but kabaddi, football, and athletics are

building strong communities. Be early, invest deeply and grow alongside the game.

India’s sports landscape is at an inflection point. Fandom is evolving, non-cricket sports are on the rise and

digital-first engagement is reshaping the game. But for brands, the real opportunity isn’t just in sponsorship – it’s in creating lasting impact by investing in athletes, communities and the fan experience. It’s time to move to true partnerships that shape narratives and actively invest in the future of sport. But growth won’t happen in isolation – it requires brands to step up as co-creators in the evolution of Indian sports. So, the real question is: are you here to place a logo, or are you here to build the game?

The showpiece event of the NFL, the Super Bowl, is often touted as one of the great sports and entertainment events of the year, in part driven by the Super Bowl Halftime Show. This intersection of passion points is often credited with driving international growth in the NFL, which it certainly does, but could fantasy football also be fuelling this?

NFL Fantasy football has its roots going back to the 1960s when a group of people connected to the Oakland Raiders competed against each other through a draft of real NFL Players. This foundational underpinning of the game remains today, becoming a multi-billion-dollar industry in itself and a huge revenue driver for the NFL, with millions of fans gathering in pubs, sports bars, and virtually, participating in fantasy football drafts at the start of every NFL season.

But what has propelled fantasy football to the place it is today where it is inherent in the fan experience of those who follow the NFL?

Technology has undoubtedly played a pivotal role allowing fans to play anywhere in the world and stay connected to a community of fans and friends every NFL game week throughout the season. The mobile experience inherently leads to Fantasy being something fans come back to week in and week out.

Broadcast programming designed at least in part to satisfy the consumption preferences of fantasy football players in the form of NFL Redzone has also driven an increase in engagement. NFL Redzone features key moments from all the games across the league. Rather than following your favorite team, NFL fantasy players have a dedicated program that will allow them to follow key moments across the entire league that will impact their fantasy team.

The increase in participation around NFL fantasy has undoubtedly had a positive impact on TV audiences overall and the resulting rights fee for broadcast rights around the world. The current TV package, running until 2033 saw an 80% increase from the prior cycle reflecting the overall popularity of the NFL.

Lastly, the format of NFL fantasy football itself, where players are matched up against other opponents in the league keeps players coming back every week, in contrast to other fantasy games where players have a tendency to set their team and leave it for the entire season. This has resulted in a greater proportion of NFL fans engaging in fantasy football Leagues than other US-centric sports (12.7% NFL fans, 8.5% basketball fans, and 8% baseball fans via GWI Sport).

The Impact on International Audiences

The NFL has recently announced additional regular season games to take place in Ireland and Australia signalling the ongoing commitment to continued growth of the league outside the USA. Next season, the NFL will have seven games played internationally including games in London, Sao Paulo, Berlin, Madrid, and Dublin.

Fantasy football is undoubtedly contributing to the growth of the NFL internationally by increasing interest in teams and players where there is no natural local interest, deepening engagement and making football more accessible to more fans.

Compared to 10 years ago, online conversations around NFL Fantasy Football have grown by 43% as globalization of the sport has picked up pace (Source: Brandwatch).

The Commercial Impact of Fantasy Football

This growth in popularity in fantasy football has seen a broader commercial ecosystem grow around it. The data and analytics elements of the game have parallel interest with betting brands for some fans, enticing an already existing audience onto the platform. Now advertisers are buying inventory within the game itself, including several betting companies, such as Draft Kings and 888sport. Data providers, analysis platforms, and trade and draft generators also benefit from the broader commercial opportunity; by, in some instances, charging fans a subscription price to increase their likelihood of success in their leagues.

Advertising revenue for broadcasters has been positively impacted by the increase in viewership driven by fantasy football. So much so that some brands are creating TV ads specifically related to the Game.

The Future of Fantasy Football

As we look to the future of fantasy football, there is plenty of scope for technology to continue to power the growth of the game for fans. The demand for personalized and bespoke content will only continue to grow for NFL fantasy football players and the brands that want to engage with them. The NFL fantasy audience is 41% more likely than the general population to advocate for brands when they have access to exclusive services.

AI in particular has the capacity to enhance the fan experience by providing customized, real-time stats, predicting player performance, automatically adjusting lineups and proactively suggesting trades and free-agent pickups in a way that is much deeper than existing platforms can do

Additionally, as customized broadcast feeds become a reality, the possibility of fans being able to have bespoke programming or highlights packages reflecting their fantasy teams may become a reality in the near future.

The Masters Tournament — a name synonymous with prestige, history, and timeless tradition. From the iconic green jacket to the immaculately manicured fairways of Augusta National, The Masters is more than just a golf tournament; it’s a symbol of exclusivity and excellence. For brands, aligning with The Masters is a golden opportunity — but one that comes with a unique challenge: how do you innovate and engage modern audiences without disrupting the event’s classic, traditional feel?

As the sports marketing landscape evolves, so too must sponsorship strategies, even at an event as rooted in tradition as The Masters. The future lies in a delicate balance — blending innovation with the time-honoured principles that make The Masters, quite simply, “a tradition unlike any other.”

The Masters’ Unique Approach to Sponsorship

Unlike many sporting events, The Masters limits its sponsors to a select few with minimal on-course branding and a strict focus on subtlety. There are no large banners, flashy commercials, or over-the-top activations. Instead, The Masters allows brands to benefit from association rather than saturation.

This minimalist approach works because it mirrors The Masters’ values: exclusivity, sophistication, and class. For sponsors, the reward isn’t mass visibility — it’s credibility by proximity.

However, the challenge for the future is clear: how do these brands continue to engage an evolving audience, particularly a younger audience, without compromising The Masters’ essence?

Where Innovation Meets Tradition

1. Enhanced Digital Experiences

Despite significant developments in recent years in television viewing, The Masters live television broadcast is still very limited in comparison with other major championships with only 5 hours of live coverage shown per day with limited featured groups shown. In light of Augusta National historically showing caution about technology, recent years have shown a willingness to embrace digital platforms in carefully controlled ways. The Masters app and website both offer immersive features like real-time player tracking and personalised highlight reels which have become increasingly popular and something I look forward to each year.

Future digital opportunities for sponsors at The Masters:

o AI-Powered Content: AI has the potential to redefine the way fans experience The Masters, delivering hyper-personalised updates and predictive insights in real time. Imagine an AI-powered personal caddie embedded within The Masters app, offering real-time shot recommendations, historical data comparisons, and tailored viewing experiences. Users could engage with AI-driven features by asking:

• “What are the chances Scottie Scheffler makes this putt?”

• “How did Tiger Woods play this hole in 2019?”

By leveraging historical tournament data, course conditions, and player tendencies, AI could create a smarter, more interactive way for fans to follow the action—both on-site and remotely.

o Augmented Reality (AR): Given the exclusivity of attending The Masters, AR presents an opportunity to bring Augusta to the fans, no matter where they are. Virtual course walk-throughs could allow users to experience Augusta’s iconic holes in 3D, providing an immersive perspective from their own living rooms.

The 2024 introduction of the Masters VR App for the Apple Vision Pro headset marked a significant step forward, but there’s potential to expand this even further. Future enhancements could include:

• “Then vs. Now” Shot Comparisons: AI-powered AR overlays could place current players’ shots alongside Masters legends, comparing power, trajectory, and decision-making.

• Live AR Shot Tracking: Viewers could use their phones or headsets to track ball flights, green slopes, and wind conditions in real time.

By expanding on these digital innovations, sponsors can elevate the Masters experience for both in-person attendees and remote viewers, ensuring the tournament’s legacy remains as forward-thinking as it is steeped in tradition.

2. Subtle Social Media Integration

The Masters’ social media presence has grown, but it remains refined and measured. Sponsors could lean into this by creating content that complements The Masters’ brand — think behind-the-scenes storytelling, spotlighting the craftsmanship behind the green jacket, or showcasing the quiet luxury of Augusta’s hospitality suites.

Influencer collaborations, though understated, could also play a role — focusing on thought leaders in golf, sports fashion, or luxury lifestyles who embody The Masters’ elegance, especially in an era where influencer golf is becoming ever presence in the industry and making its way into traditional golfing media platforms.

3. Sustainability Partnerships

With growing global emphasis on sustainability, future sponsors may align with The Masters’ eco-conscious efforts. Augusta National already takes environmental stewardship seriously, and brands could deepen this by promoting green initiatives — from Mercedes-Benz showcasing electric vehicles to partnerships aimed at reducing the tournament’s carbon footprint.

4. VIP Virtual Access & Hospitality: The Untapped Digital Opportunity The Masters is synonymous with exclusivity and tradition, making on-site hospitality a premium asset for sponsors. However, in 2020, brands were forced to pivot, leveraging virtual experiences to engage VIP clients in the absence of patrons. Initiatives ranged from exclusive online watch parties to bespoke brand experiences, but despite the return of full crowds, digital hospitality has remained largely underdeveloped.

Looking ahead, sponsors have a significant opportunity to build on the digital innovations introduced in 2020 and 2021 by developing hybrid hospitality models. Imagine a virtual “members-only” suite, where top clients and partners gain exclusive access to:

• Live Q&As with past Masters champions.

• Virtual cocktail hours hosted by brand ambassadors.

• Digital networking events tied to the tournament.

Additionally, brands could extend engagement beyond Augusta with interactive experiences such as virtual golf challenges, where fans compete in online simulators replicating the Masters Pro-Am. These activations could include celebrity or player-hosted coaching sessions, capitalising on the growing popularity of tech-driven golf experiences like TGL, where players are becoming increasingly comfortable with virtual competition. By integrating digital-first hospitality, brands can enhance the Masters experience for VIPs, ensuring year-round engagement rather than limiting it to tournament week.

5. Data-Driven Engagement

With a younger, tech-savvy audience tuning in, brands may leverage data analytics to create more personalised sponsorship activations. Targeted digital campaigns, using insights from app usage and social engagement, could help sponsors tailor their messaging without ever detracting from The Masters’ classic atmosphere.

The Challenge: Preserving The Masters’ Essence

Ultimately, The Masters will always be about golf first — not corporate noise. The tournament’s leadership has a proven track record of protecting its brand integrity, and future sponsors will need to operate within those same guardrails.

The key for brands will be to embrace innovation that feels seamless — technology that enhances the fan experience, not distracts from it. It’s not about making The Masters louder or flashier; it’s about making it more immersive, more personal, and more connected for the fans, all while maintaining the quiet grace that has defined Augusta for nearly a century.

Conclusion: Walking the Tightrope of Tradition and Innovation

As the sports marketing world races forward, The Masters will remain a masterclass in subtlety — an event where tradition reigns and branding whispers rather than shouts. Yet, there’s room for evolution.

The future of sponsorship at The Masters lies in thoughtful innovation — in using technology to deepen engagement, embracing sustainability, and leveraging digital platforms in a way that feels organic to Augusta’s timeless charm.

For brands, the challenge isn’t just gaining visibility at The Masters — it’s earning the right to stand alongside one of the most revered tournaments in sports history.

Formula 1 has always been a sport that combines both heritage and innovation. Historically dominated by luxury brands, oil giants and watchmakers, it is now undergoing a significant commercial transformation. Sponsors such as Rolex, Petronas and Shell, who have been pillars of F1 for decades, now face competition from disruptive new players. Crypto companies, fashion brands and tech giants are seizing F1’s global growth, changing the way sponsorships function across teams, drivers and fan engagement.

With a younger, digitally engaged fanbase emerging, largely driven by the success of Drive to Survive and F1’s expansion into new markets, Brands now recognise the need to connect with audiences through deeper storytelling, engagement, and alignment with modern values such as sustainability and innovation to build meaningful relationships with this new generation of fans.

Teams: The Shift from Traditional Partners to Modern Investment

For many years, F1 teams have relied on established sponsors, ranging from oil companies to high-end consumer brands, to fund their operations. These partnerships not only provided financial stability but also reinforced F1’s image of luxury. However, newer brands are now challenging this traditional model.

Tech giants like Google and AWS have gone beyond typical sponsorship, embedding their technology into team operations. Fashion houses such as Boss and Tommy Hilfiger are transforming partnerships into lifestyle collaborations. On the other hand, the rise and fall of crypto sponsorships has revealed the risks associated with chasing short-term financial gains. The 2022 fallout of FTX from Mercedes, for example, exposed the volatility of these new players and forced teams to rethink their commercial partnerships. (1) This year, we saw the first ever F1 deal that was paid completely in cryptocurrency, with the partnership between Aston Martin and Coinbase. (2)

As the sponsorship landscape evolves, teams are increasingly having to strike a balance between the legacy stability of long-term sponsors and the fresh investment and innovation offered by new players. The most successful teams will be those that align with brands capable of evolving with the sport.

Drivers: From Team Ambassadors to Global Influencers

F1 drivers are no longer just athletes. They have become global influencers, shaping consumer trends and brand perceptions beyond the track. While sponsorships were traditionally handled at a team level, today’s drivers are creating their own high-profile partnerships, redefining how brands interact with the sport.

Lewis Hamilton’s collaboration with Lululemon (3), Charles Leclerc’s association with APM Monaco and Carlos Sainz’s partnership with L’Oréal Paris (4) highlight how drivers have become powerful marketing assets. Their influence stretches beyond motorsport, allowing brands to tap into new audiences and form stronger connections with fans. However, this shift also brings challenges. As drivers form personal sponsor relationships, potential conflicts with team-wide partnerships must be managed carefully to ensure a cohesive commercial strategy. An example of this is Charles Leclerc being a brand ambassador for luxury jewellery brand APM Monaco. (5) While this makes sense due to the driver being from Monaco, it could be seen as ironic due to the FIA’s strict new safety regulations restricting jewellery for drivers, which became a lot stricter in 2022, which was the year Lewis Hamilton clashed with the FIA over his jewellery, particularly a permanent nose stud. (6)

As F1 embraces a digital-first approach to fan engagement and lifestyle branding, drivers play a central role in shaping the sport’s sponsorship landscape. Their ability to connect heritage brands with modern consumer trends makes them invaluable assets in F1’s evolving commercial ecosystem.

Fans: The Changing Expectations of Engagement

F1’s fanbase has undergone a significant shift in recent years, with a growing proportion of younger, digitally savvy fans driven by the rise of Drive to Survive. This new fanbase means that an increasing number of fans are craving more interactive experiences, exclusive content and meaningful engagement.

While legacy brands like Rolex maintain their prestige, newer sponsors are focusing on digital activations, social media campaigns and immersive fan experiences. Red Bull, for example, has revolutionised sponsorship by integrating extreme sports, digital storytelling and fan engagement into its F1 strategy.

Fashion and tech brands have emerged as more stable partners that understand the long-term value of fan engagement. These brands, such as Boss and Google, offer collaborations that go beyond visibility and extend into the lifestyle of fans. For example, fashion brands use drivers as ambassadors, bringing F1 into fans’ daily lives and creating content that resonates on social media platforms. (7) Similarly, tech brands enhance the fan experience through digital innovations, giving fans more access to data and insights while enhancing their connection to the sport.

These long-term, fan-focused partnerships demonstrate the shift in sponsorship strategy. The most successful brands are those that understand the evolving expectations of F1’s global fanbase, aligning their values with the sport’s digital transformation and delivering more than just traditional branding.

The Risk of Chasing the Highest Bidder

If F1 focuses solely on securing the highest bidder, it risks compromising the very prestige that has made the sport iconic. Legacy sponsors like Shell and Petronas have built F1’s financial foundation and bolstered its luxurious image, attracting a dedicated fanbase that values the sport’s tradition and exclusivity. These fans connect with F1 not just for the spectacle but for the heritage it represents, a world of high performance, craftsmanship and elite brands.

Prioritising short-term financial gains from brands that may not share these values could dilute F1’s essence. The influx of new brands, particularly in the crypto and tech sectors, may bring in immediate revenue but could feel transactional rather than rooted in the sport’s culture. If F1 focuses too much on securing the biggest pay checks from passing trends, it risks alienating its loyal fans who are drawn to its history and prestige. These fans seek authenticity and brand alignment that reflects the high standards and legacy of F1.

The shift towards mass-market could create a divide between F1’s loyal, core audience and the new wave of followers who are attracted by more superficial sponsorships. It could lead to a loss of connection between F1’s brand identity and its most dedicated supporters, who may feel the sport has lost its exclusivity and cultural value. For F1 to succeed in the long term, it must balance embracing new, innovative sponsors with maintaining the authenticity and prestige that has made it a global phenomenon. The future of F1’s sponsorship ecosystem should focus on partnerships that reflect its legacy, ensuring growth while preserving its identity.

The Future of F1 Sponsorship

F1’s commercial ecosystem is at a crossroads. Legacy sponsors must evolve to stay relevant while newer brands must demonstrate their ability to offer long-term value instead of short-lived financial gains.

The most successful partnerships will be those that strike a balance between heritage and innovation, combining prestige with modern engagement strategies. In a time where passive sponsorship is no longer enough, F1’s future belongs to brands willing to evolve, connect with fans, new and old, and drive commercial success in new and dynamic ways.