For too long, women’s health has been overlooked in the workplace. While there’s been progress, we’re still only just beginning to have honest conversations about the impact of menstrual health, menopause and the broader impact of female wellbeing on women’s work lives.

At Fuse, we were proud to work with Vodafone and the Welsh Women’s Rugby team on a campaign to launch a menstrual cycle tracking tool, a great example of how sport can lead the way in putting women’s health front and centre. The Women’s Euros this summer represents another platform to push these conversations further and shine a light on the real, lived experiences of women, both on and off the pitch.

We must move beyond tokenism and actively create environments where women feel in a safe space to discuss their health without fear of stigma or professional impact. That means more inclusive policies, from flexible working that reflects hormonal health, to better education for managers, and clear support systems in place.

Future female workforces will expect this as standard, not as a perk. It’s time we caught up. The talent is there, and the ambition is there, but we need to meet it with structures and support that allow women to thrive throughout every stage of their career.

Louise Johnson, the global chief executive of Fuse, believes we’re entering a “golden age of sports marketing and partnerships”.

However, attention spans are narrowing and consumers are being bombarded from every angle by advertisers as well as sponsors, which makes it harder for brands to stand out.

Platforms such as billboards, murals and other forms of out-of-home (OOH) advertising might still serve a purpose, but at a time when people increasingly have their heads in their phones it is the sponsors that are leaning into new technologies to create more immersive experiences that are cutting through.

For brands with bigger budgets in particular, innovations like artificial intelligence (AI), augmented reality (AR) and even holographic technology are enabling sponsors to deepen connections with fans and tell stories in different ways.

“I think as an industry, we are much better at really being progressive and using the assets in a creative and integrated way,” Johnson says. “I think the next frontier is how do you keep evolving sports marketing assets to make sure that they are really fit for modern sports marketing.

“So how are you connecting it to commerce? How are you looping in with streaming platforms? How do you use first party data to really personalise your activation, and also the role of AI within activation as well.”

It’s never been enough to simply run an ad or experiential activation without supporting PR coverage and media.

But the variety of marketing channels now available means sponsors can put together campaigns that continue to come to life through a variety of in-person and virtual activity even after generating an initial buzz at launch.

“There’s a really interesting point around how it’s not only about integrated marketing and using it in all of your channels, but actually putting sport or culture at the center of your broader marketing mix, and having everything around that,” Johnson adds.

“So whether that be creative, media and commerce, I think that’s where you’ll start seeing some really interesting work moving forward.”

The rise in technical talent and rich player storytelling has driven cultural momentum behind women’s football. Gen Z and Gen Alpha audiences are emotionally invested and demanding equal representation. Major global brands are now consistently activating across both club and international tournaments, committing to long-term strategic partnerships, rather than one-off campaigns. We’ve moved into an era of sustained interest and belief in the women’s game. It’s no longer just a trend; it’s a cultural shift.

The time to get involved is now. UEFA is targeting over 500 million global viewers for WEURO 2025, and Switzerland’s strong infrastructure and central European location indicate it’s likely to be strongly attended on the ground. It’s a huge validation for the commercial opportunity behind sponsorship, as this level of potential reach is not something brands can afford to miss.

But with mounting pressure on UEFA and FIFA to deliver fairer funding, prize money and broadcasting rights, we’re at a crunch point. With more record-breaking sponsorship deals across multiple tournaments, brands risk stretching activation budgets thin. New approaches are needed to drive deeper impact, such as linking campaigns across properties and connected sponsorship across both men’s and women’s football, to distribute funds without undermining the women’s game.

It’s a wider conversation than brand investment; that’s just the tip of the iceberg. To achieve true long-term investment equity, we need to see meaningful action, such as revenue reinvested into grassroots programmes, league infrastructure and talent development. WEURO 2025 provides the perfect prompt to inspire this change.

“Sports is a way to hit those audiences more effectively than traditional advertising,” said Louise Johnson, global chief executive officer at Fuse, a sport and entertainment marketing agency.

Beauty plays a big role in sports. Personal care is essential to athletes; hair and makeup are powerful tools for self-expression while athletes wear a uniform, and sports and beauty both stand at the intersection of physical and mental well-being, she said. Sport is at the junction of adjacent passions, too, such as fashion, music and wellness. “Everything is crossing and bleeding over at the moment,” Johnson said. “That is why you are starting to see a lot of beauty brands coming in.”

Last year, when Charlotte Tilbury became the first beauty company and female-founded brand to be an official sponsor of F1 Academy, the female-only racing championship founded by Formula 1 that supports women drivers, it “sent a shockwave through the industry,” Johnson said.

The 2016 champion is one of several former drivers to turn to the world of finance.

When the Las Vegas race weekend gets under way, scores of fans will inevitably be lured in by the city’s bright lights to gamble their money away in its many casinos. Nico Rosberg, in contrast, will be looking to create wealth.

The 2016 Formula One champion will host around two dozen guests in the hospitality suite of Mercedes — his former team — to discuss their plans for investment.

The 39-year-old German, who shocked fans when he retired from the sport only days after winning the title ahead of teammate Sir Lewis Hamilton, has built a career outside the sport as an eco investor. Rosberg Ventures, a venture capital fund of funds the former champion launched this year, has raised more than $100mn from wealthy families and investors to deploy with investment firms, including Andreessen Horowitz, Accel and Kleiner Perkins.

“In F1, I learnt to move fast, make fast decisions and occasionally break things,” Rosberg says. “In venture capital, that’s how you get from $0 to $100mn in such a short space of time.”

Speaking to the FT via a video link from his wood-panelled offices in Monaco, Rosberg talks enthusiastically about life after leaving the sport.

He is one of a number of former F1 drivers who, having either walked away from or lost their seat at the pinnacle of motorsport, have branched out into the world of financial services. He had built a reputation during his F1 career for using his technical nous to help boost his performance on the track. After leaving the sport, he switched this analytical drive to slowly get his head around the world of finance.

Early in his retirement, Rosberg was directed by Swiss Bank UBS to build a vanilla portfolio including equity, bonds and real estate before he branched out into angel investing and venture capital — becoming involved in funding rounds for Airbnb, Lyft, and SpaceX when they were start-ups.

Rosberg now has a small team of six people running his venture fund, which has turned into a full-time job for him as he manages part of the family wealth of some of Germany’s leading industrialists.

Louise Johnson, chief executive of sports marketing agency Fuse, says that, as F1 has grown rapidly over the past decade under the ownership of Liberty Media and began to capitalise on its global reach, drivers have broadened their horizons in terms of careers after leaving the sport.

“The traditional route for drivers in the past was to commentate, become a brand ambassador, race in another series, or even buy a team,” she explains. “But a new generation is seeking other opportunities.”

F1 is ruthless and drivers rarely have an opportunity to dictate the length of their career. In the past season alone, two drivers have been dropped with several races left to run due to poor performances, and several others will move on at the end of the year having not had their contracts renewed.

“As a young driver, you have to deliver straight away or you’re out — there’s 10 other drivers waiting in line,” Rosberg says. “Look at [Franco] Colapinto,” he adds, referring to the Argentine driver who replaced American Logan Sargeant at Williams in the middle of the season.

“This is his one opportunity [to deliver] and there’s probably never going to be another one.”

The pressure cooker of F1 and the sheer focus demanded of drivers during their career leaves many unprepared for what comes next. But it can also provide a moment of clarity.

Not long after being let go midseason by the then AlphaTauri team in 2023, former Red Bull junior driver Nyck De Vries says a chance meeting with Mercedes F1 chief Toto Wolff in a coffee shop in Monaco led him to Harvard, to take an executive leadership course, after the former banker advised him to plug some of the gaps in his CV.

“I was hurt and hoped it would work out differently,” the 29-year-old Dutchman says. “But, in our industry, there is no certainty and you can’t take anything for granted. You’re only as good as your last race. I tried to quickly regroup, reset, and look ahead.”

He is part of a generation of drivers who left mainstream education early to focus entirely on their motor racing career, leaving little scope for any kind of fallback plan.

De Vries’ says the Harvard course was instructive and helped him broaden his horizons even though he subsequently returned to motorsport as an endurance racing driver with five-time Le Man winners Toyota, and to Formula E with Mahindra Racing.

“Going up the ladder to F1, everything is centred around racing and maximising your career,” he points out. “When you’re doing 24 race weekends in a year, the time you have available to explore other things is non-existent. The time [out of the sport] allowed me to explore.”

Shortly after De Vries was dropped from F1, another chance encounter with Serge Savasta, chief executive of Omnes Capital, which manages €6bn in assets and specialises in green transition investments, piqued his interest in private equity.

De Vries, who developed an interest in green investments during his first successful spell in Formula E at that start of the decade, has worked with Omnes to develop an “accelerator programme” that can help other professional sportspeople learn about private equity.

“I want to race for as long as possible,” he says. “But, in order to stay relevant in the future, I’ve developed an interest in business.”

Rosberg still remembers feeling scared during his first few months after leaving F1: “I didn’t know what was coming next,” he says. “It wasn’t until five years ago, that I finally understood where I needed to be going . . . Now I know exactly.”

20 March 2025, Oslo, Norway: Leading global sports and entertainment agency Fuse, part of Omnicom Media Group, has announced Marius Ramdahl as Head of Fuse Nordics. The creation of the new regional role follows the recent expansion of Fuse into Sweden and Finland. Through Fuse, OMG will leverage the growing potential of sports and entertainment marketing in the Nordics, offering consultancy services to support brand advertisers with their partnership needs.

Ramdahl has been selected to lead the regional Fuse business unit from Oslo; the appointment will be an additional remit to his successful six-year tenure as Managing Director of Fuse Norway. The Norwegian office has already gained significant recognition by winning gold at the global Festival of Media and Sabre Awards, as well as gold in the Gullblyanten, Medieprisen, and Sponsor & Eventprisen competitions.

CEO of Omnicom Media Group Norway, Espen Klepper, is particularly pleased that his Norwegian colleague has been chosen to lead Fuse in the Nordic region. “I have nothing but praise for Marius, and there is no doubt that what we have achieved in Norway so far has been a fantastic success. We clearly see that our clients are increasingly looking for ways to engage more deeply with their audiences, and sports and entertainment are platforms that truly deliver on this. The launch of Fuse in the Nordics will undoubtedly strengthen our commitment to bringing brands closer to people through the things they love,” says Klepper.

Ramdahl himself is excited about the new challenges: “It has been an absolute pleasure to lead Fuse in Norway from the very beginning, and I look forward to the challenge of a broader presence in the Nordic market. Many of our clients operate across borders, so we look forward to offering them a wider range of services in the region while also helping to elevate local brands in each country through the power of sports and entertainment.”

The sponsorship market in the Nordics amounts to over 20 billion NOK, with the majority of investments directed toward the sports category. “With our holistic approach to commercial partnerships, combined with our extensive international experience, we are aiming to take a leading position in the Nordic market. We are proud of what we have achieved in Norway so far and are highly motivated to build on this success in our new markets,” Ramdahl concludes.

Commenting on the Nordic launch, Louise Johnson, Global CEO of Fuse, stated: “Our extended coverage in the Nordic region is a crucial strategic move for Fuse – not only to enable us to leverage the significant opportunity we see in this region, but also to deliver more to the existing Fuse client base – many of which require regional support. As part of OMG, Fuse is uniquely positioned to unlock the potential in this region: combining the group’s leading data and technology capabilities – – powered by the industry-leading Omni open operating system – with our expertise in connecting brands to culture through effective partnerships truly sets us apart.»

Fuse recently launched in Sweden and Finland, led by Chris Drake and Sanna Tamminen, respectively.

During this decade, we have seen globally acclaimed sports like football, motorsport and basketball commit to championing the women’s game. Therefore, we are seeing more women step up to be the face of the women’s game, such as Leah Williamson, Bianca Bustamante, Caitlin Clark and Angel Reese to name a few.

However, within the last year we have seen one woman’s career and profile transcend their sport at an unprecedented rate. Ilona Maher has become nearly impossible to miss, managing to build her brand and effortlessly adapt to the changeable appetite of society, popular culture and social media. She has shown that female athletes’ potential can be bigger than just the dimension of their sporting career. But what has this looked like and what can it teach the industry about incubating the future talent that are surely hot on her heels?

It is Ilona’s world, and we are all just living in it

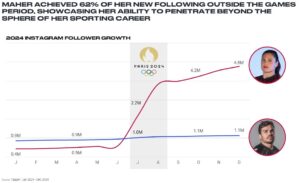

With her bubbly, straight-talking personality, Maher gained over 6M additional followers across Instagram and TikTok since the Paris 2024 Olympics, dwarfing the growth of male rugby royalty such as Antoine Dupoint. Online buzz around the athlete increased by 4,824% from 2023 to 2024.

This “Beast, Beauty, Brains” athlete has become a force of her own, galvanising support for whatever direction she takes her career. For example, her shift from rugby sevens to rugby union has raised the profile of the English game and its teams. This was evident in her signing announcement with Bristol Bears, which helped the club gain over 22K followers on TikTok in the week following the reveal.

Source: Bristol Bears TikTok account (@bristolbearsrugby)

The announcement post alone generated 366.7K visible engagements, making it their most successful piece of content since starting their page in 2024 – an increase of +2,918%, compared to their channel average (12.2K visible engagements)[1].

A sticking point for female athletes in building fandom beyond their individual sport to wider sports fans is often a lack of authentic male allyship and support that feels genuine rather than obligatory (as seen in traditional partnerships between men’s and women’s national teams). The strong endorsement for Ilona from male rugby legends like Dan Cole and Ben Youngs likely played a role in firstly, helping newfound women’s rugby fans feel included and accepted as part of the rugby world, and secondly, instigating conversation and curiosity for the women’s game amongst the men’s rugby community.

Ilona’s influence has also extended beyond the pitch. She often stole the show on Dancing With The Stars, with social media snippets of her iconic dances being some of the most popular content on their Instagram (4 of the top 5 posts feature Ilona), amassing just under 2M visible engagement [2]. She also was recognised and celebrated for her empowered femininity as a cover star on Sports Swimsuit Illustrated, People and Cherry Bombe.

In short, 2024 saw the full force of the Ilona Maher effect, with her influence making her bigger than rugby, and providing a blueprint for future female talent in the sport and entertainment space.

The Ilona cheat code

Ilona straight-armed her way through the glass ceiling, and her success is far from accidental. Whilst societal and contextual influences have played a role in creating an environment where she could flourish, Ilona and her team have been highly intentional with her brand and image.

Firstly, with over 5 billion users on social media channels globally [3], Ilona has leveraged the world’s insatiable consumption of content to expand her reach and connect with as wide an audience possible. On the podcast The Good, The Scaz & The Rugby, she highlighted the difference in her attitude towards social media versus her teammates, admitting that she embraces scrolling as part of her work, always researching social media trends to widen her audience appeal. Maher’s channels are reflective of popular culture but also infuse her signature Ilona twist with the occasional “sprinkle of rugby”, enticing curiosity amongst her new audiences, potentially converting them into engaged fans.

Secondly, the current political and societal climate is tumultuous, and in extreme cases hostile towards any kind of otherness. Ilona is passionate about empowering people and instilling self-belief through comedic sincerity. Naturally, being in the public eye invites intense public scrutiny but Ilona’s ‘take-me-or-leave-me’ attitude cleverly acknowledges but denies power to the unsolicited opinions from trolls or anti-fans. Maher is also an unapologetic ally for the talent of others, as we’ve seen post-Olympics, when she used her newfound influence and notoriety to encourage her audience (4.8M of which she gained during the Olympic period [4]) to keep audiences engaged with the Paralympics. Ilona is a fierce advocate for self and otherness acceptance, which is something the world needs now more than ever.

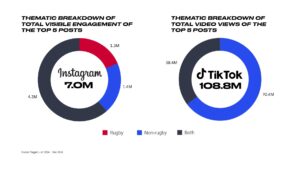

Finally, Ilona challenges the rigid standards put on female athletes – and women generally – reminding us there is no right or wrong way to exist. She has not pigeonholed herself as just an Olympian (although it is an impressive pigeonhole) or just an online personality. Her ‘say yes’ approach to non-rugby opportunities has helped her to cultivate her fandom beyond the women’s rugby sphere, giving her an ongoing relevancy within pop culture. This is most clearly reflected on her social media, specifically on her Instagram and TikTok where all or the majority of her top 5 posts are unrelated to rugby or not solely rugby focused (breakdown can be found in the Appendix).

How can brands (and rightsholders) harness such power

While 2024 was Ilona’s year, she has been grafting hard on social media, cultivating her brand since her first Olympic appearance at Tokyo.

Keeping abreast of the current talent landscape – looking at top performers, emerging personalities, and intersectionality innovators between their industry and culture – is key. Spotting these stars early will help brands to align and build in conjunction with their success. Whilst there is only one Ilona Maher, there are others like her across sports and entertainment waiting to be discovered.

Authenticity matters – fans can see through surface-level partnerships that simply feature the most followed/biggest stars. If brands want to use talent effectively, they need to identify and clearly define what their assessment criteria is before researching potential ambassadors/collaborators. Knowing what data-led and subjective brand fit KPIs are important for improving your brand’s image is key to aligning with the best talent. These pre-determined selection criteria can also be used as part of a measurement framework to monitor the effectiveness of the talent and identify actionable insights to improve campaign strategy. By taking a strategic approach, brands can identify talent avenues that naturally complement their identity, ensuring partnerships feel genuine and create mutual value.

Once you have identified and signed talent, they should have a seat at the creative table. By actively including talent in creative brainstorms, brands can ensure that the signature flare and persona that makes them beloved is organically weaved into the campaign’s fabric. A recent example of this for Ilona was the Adidas partnership, which still had the brand’s style but through Ilona’s lens. Ilona has helped to further this by providing supplementary behind-the-scenes content on her own channels, emphasising that she is more than just a face in the brand’s ambassador roster, but a proactive part of the Adidas family.

Rightsholders should start considering the social influence and inventory that their female talent and performers are building. Understanding their passion points and social media literacy in general can help rightsholders:

Ilona’s success didn’t happen overnight, despite 2024 appearing that way. She put in the work, and for the rest of this decade, many more female athletes will follow suit. Brands that take notice sooner rather than later will give themselves a head start to create and harness their own Ilona Maher effect.

Sources

Appendix:

Breakdown of top 5 posts on Ilona Maher’s Instagram and TikTok channels:

| Visible Engagement | TikTok | Views | |

| Comparison between Ilona on the red carpet and before a rugby game | 1.9M | Dancing with the Stars – Leg Lift Challenge | 29.5M |

| Meeting Snoop Dogg | 1.4M | ‘When you and your friends are complete opposites’ | 22.5M |

| Olympic Medallist Portrait | 1.3M | Making Moves in the Olympic’s Villa | 20.7M |

| Making Moves in Olympic’s Villa | 1.2M | Paid Partnership with L’Oreal Paris | 18.4M |

| ‘Women can do it all’ | 1.2M | Dancing With the Stars Funny BTS | 17.7M |

Once considered a niche motorsport with a predominantly European following, Formula 1 has exploded into a global phenomenon in recent years, fuelled in large part by Netflix’s Drive to Survive. F1: The Movie builds on this momentum, delivering cinematic excitement but also a deeply authentic, culturally resonant portrayal of the world of modern Formula 1. The film leverages this unique cultural moment for the sport, using the global fascination inspired by Drive to Survive as a springboard and leaning into what fans love most: real access, real emotion and real racing.

But this is more than just a film – it’s a cultural inflection point. F1: The Movie blurs the lines between sport, entertainment, and storytelling, offering a new blueprint for how sports properties can engage fans beyond the track. It signals a shift from passive sponsorship to active participation in the stories fans care about.

From the first email, when director Joseph Kosinski reached out to seven-time world champion Lewis Hamilton, the vision was clear; to make something real and accurate. Hamilton, who served as a producer, was instrumental in ensuring the film mirrored the identity of the sport. To achieve this, a fictional “11th team” was created, APXGP, fully integrated into the 2023 and 2024 F1 seasons with its own motorhome, garages, team sponsors, and interacting seamlessly with real teams and drivers across specific race weekends. The two lead actors, Brad Pitt and Damson Idris, trained to drive modified F2 cars designed to look and feel like F1 vehicles. This realism, supported by a specially developed camera system tailored to the unique demands of high-speed racing, deliver a radical on-track perspective bringing audiences and fans closer than ever to the speed, precision and experience of Formula 1.

The authenticity of F1: The Movie is amplified further through the film’s commercial integration which mirrors the business engine that drives modern Formula 1. APXGP’s team livery features real sponsors including MSC Cruises, Expensify, SharkNinja, and Tommy Hilfiger – brands that clearly recognise the sport’s growing global influence. These partnerships go beyond simple product placement; they’re part of a larger ecosystem positioning F1 as an ideal platform for premium, lifestyle-driven marketing.

Tommy Hilfiger stands out as a brand that has maximised the sponsorship with a bold activation strategy not only designing the APXGP team suits, but launching a capsule collection inspired by the film. The brand integration reached a new level at the 2025 Met Gala where Damson Idris arrived in a real APXGP car wearing a bespoke Tommy Hilfiger racing suit and a Swarovski-crystal-encrusted helmet. On the red carpet, two assistants performed a “pit stop,” removing Idris’ racing suit to reveal a tailored Tommy Hilfiger suit underneath, aligned to the evening’s theme. The Met Gala appearance was more than just a viral spectacle, it was part of a fully integrated marketing campaign. The APXGP Collection, modelled by Idris, is now being marketed worldwide, with a global out of home and digital campaign rolling out across multiple channels, amplifying brand visibility and connecting F1 to a broader lifestyle audience. The impact of the campaign has been noted by other sponsors, such as Expensify, who also saw a surge in brand engagement following the Met Gala reveal.

These kinds of activations serve as a gateway to new audiences. The Met Gala moment wasn’t just for motorsport fans; it was for culture-watchers, fashion enthusiasts, and digital natives who may have never tuned into a Grand Prix but instantly connected with the spectacle. By tapping into culturally charged moments, F1 and its partners are expanding the sport’s cultural footprint, through moments that feel relevant, shareable, and emotionally resonant across different verticals. As Apple CEO Tim Cook described the film, it’s “the intersection of technology and sport” – and the Met Gala moment exemplified exactly that, where entertainment, fashion, and motorsport collided on a global stage.

Some may also question the risk it poses for brands if the film doesn’t perform well or underdelivers – however, the smartest activations aren’t just betting on box office numbers. They are building campaigns that stand on their own where it isn’t a one-off product placement and are creatively valuable in their own right.

With Hamilton’s guidance, racing integration, revolutionary technology, and real-world commercial partnerships, this film sets a new standard for motorsport storytelling and marketing. F1: The Movie is more than a Hollywood drama. It’s a culturally resonant, deeply authentic celebration of Formula 1 and a global marketing platform expanding the fanbase whilst showcasing the sport’s unmatched opportunity and commercial potential. Additionally, it offers a glimpse into the future of brand storytelling – one where entertainment doesn’t just support sport, but builds the platform itself. The fictional APXGP team wasn’t an add-on: it was engineered from the ground up with brand integration at its core. That gives brands a seat at the creative table from day one, enabling deeper engagement with fans. As the lines between sport, culture, and entertainment continue to blur, F1: The Movie isn’t just a cinematic milestone – it’s a playbook for how brands can show up authentically and drive relevance.

Fuse partners with Sipsmith to launch new Wimbledon-exclusive gin, Top Seed

26th June, 2025, London – Sipsmith has appointed global sport and entertainment marketing agency Fuse as its agency for partnership consultancy and activation, as it launches Top Seed Gin to celebrate the fifth year of its partnership with Wimbledon.

The born-and-bred London gin brand has crafted a new, limited-edition signature serve exclusively for The Championships. This first-of-its-kind recipe features authentic Wimbledon Centre Court grass seeds as one of its botanicals, distilled into the liquid using the same meticulous process behind Sipsmith’s iconic London Dry Gin. A team of expert distillers handcrafted the recipe at the brand’s Chiswick distillery, where every bottle of Sipsmith gin is made.

Fuse led the creative concept for Top Seed, from ideation to exclusive launch at an event hosted by Wimbledon legend and Sipsmith ambassador, Sue Barker, where guests were treated to a behind the scenes look into how the unique gin was created.

Tennis fans will be able to order Top Seed Gin by requesting a ‘secret serve’ at the Pergola Bar. The off-menu cocktail, The Top Seed, pairs the gin with Cloudy Apple Juice, Elderflower Cordial, Supasawa and a splash of soda. Each serve will also come with a bag of Wimbledon seeds so fans can grow their own botanicals at home, making a memorable experience for tennis fans and gin lovers alike.

Fans not able to make it to SW19 will still be able get their hands on The Top Seed’s authentic grass-based mix by signing up to Sipsmith’s Sipping Society.

In the lead up to Wimbledon, Fuse is also providing end-to-end delivery support, from strategic consultancy to onsite activations at the Pergola Bar and hospitality suite. Fuse will also manage ticketing and hospitality to ensure a seamless experience for Wimbledon-goers throughout the tournament.

Danielle Barwick, Group Director at Fuse, said: “We’re thrilled to be partnering with Sipsmith to work on this iconic Wimbledon partnership. From creative ideation to on-site execution, our team is dedicated to delivering a bold, celebratory campaign that blends Sipsmith’s spirit and commitment to craftsmanship with the tradition and prestige of The Championships. We’re looking forward to one big splash this year!”

Amy Cockram, Global Senior Brand Manager at Sipsmith, said: “Fuse’s expertise and experience in creative activations, experiential events and PR makes it the perfect partner to help us celebrate our collaboration and capture the spirit of Sipsmith and the magic of The Championships. We’re excited for more truly unforgettable moments at the most prestigious global sporting event on the calendar this year. ”

ABOUT FUSE

Fuse is a global sport and entertainment agency offering marketing and commercial services for brands and rights holders. It has offices in the UK, Europe, the Americas and Asia with over 400 employees internationally, recently opening hubs in Spain, Brazil and India. Its global CEO is Louise Johnson – one of Sports Leaders Under 40 and this year’s Jury President of the Entertainment Lions for Sport at Cannes Lions. Fuse’s work has been recognised across industry leading awards including Cannes, The Sports Industry Awards and the UK Sponsorship Awards. https://fuseint.com/

Omnicom Media Group is the media services division of Omnicom (NYSE: OMC), a leading provider of data-inspired, creative marketing and sales solutions.

Gamechangers and Rainmakers is the story of how sport became big business, along with 40 pivotal moments that helped create a trillion-dollar global entertainment industry.

The growing relationship between sport, television and the advertising industry has been key to this development – as have the boundless ambitions of influencers such as Bernie Ecclestone, Billie Jean King, Rupert Murdoch and the founders of Adidas and ESPN.

The 1980s was the defining decade when sport morphed into primetime entertainment and Nike invented the playbook for brands. Ten years later, Sky won the inaugural Premier League TV contract, UEFA re-launched the European Cup, and a global fan base got hooked on the real-world drama of football, fantasy league, videogames and online betting.

As the value and profile of sport soared, investors wanted to own teams, while prosperous nations wanted to host the top events – which led to a firehose of unregulated cash and rogue behaviour by some of sport’s top bosses.

This fascinating book analyses how and why this happened, exploring the new challenges facing sport, such as how it must adapt to stay relevant to young people. Did sport peak at Paris ’24 or is the best still to come?

About David Stubley

David spent the first decade of his career working in television at ITV and Channel 4. The last 25 years have been spent advising some of the world’s top brands, governing bodies and sporting properties on how to unlock value through sports marketing.

He wrote this book for two reasons. First, to tell the untold story of how sport morphed from being an amateur pastime played on Saturday afternoon – to killer content for modern day brands and broadcasters. Second, to provide a rallying cry to sports leaders to create a roadmap for their sports which excites the next cohort of fans: A restless generation who see the world (and consume content) very differently to their parents.